Arciel Token Economic Model

A carefully designed tokenomics model that aligns incentives, ensures network security, and creates sustainable value for all participants in the Arciel ecosystem.

Token Utility & Functions

Arciel Token serves multiple critical functions within the Arciel ecosystem, creating genuine utility and demand for the token.

Network Transaction Fees

Arciel Token is used to pay for all operations on the Arciel network. Fees are algorithmically adjusted based on network load.

Staking & Validator Security

Stake Arciel Tokens to become a validator or delegate to existing validators to secure the network and earn rewards.

Governance & Voting

Arciel Token holders can propose and vote on network upgrades, parameter changes, and treasury allocation.

Premium Access & Services

Arciel Token holders gain priority access to network services and exclusive features during high congestion.

Economic Flow & Incentives

Understanding how value flows through the Arciel ecosystem and creates sustainable incentives for all participants.

Users

Pay Arciel Tokens for transactions and cross-chain operations

Network

Processes fees: 30% burned, 70% to validators

Validators

Stake Arciel, secure network, earn rewards

Vesting Schedule Overview

Carefully designed vesting prevents token dumps and aligns long-term incentives

Ready to participate in the Arciel Token ecosystem?

Join our community and stay updated on the token launch details.

TGE Allocation Details

Comprehensive breakdown of token allocation at Token Generation Event

| Allocation Category | % of Total Supply | Amount of Token | Unlock % at TGE | Cliff Period (months) | Vesting Period (months) | TGE % of Total Supply |

|---|---|---|---|---|---|---|

Public Sale | 20% | 420T | 25% | 0 months | 0 months | 5.00% |

Ecosystem Fund | 25% | 525T | 15% | 0 months | 60 months | 3.75% |

Reserve & Treasury | 20% | 420T | 10% | 12 months | 48 months | 2.00% |

Team & Founders | 15% | 315T | 20% | 6 months | 48 months | 3.00% |

Seed Investors | 10% | 210T | 30% | 12 months | 12 months | 3.00% |

Advisors | 5% | 105T | 35% | 12 months | 12 months | 1.75% |

Network Validation Rewards | 5% | 105T | 20% | 0 months | 24 months | 1.00% |

| Total | 100% | 2.1Q | - | - | - | 19.50% |

Public Sale

Ecosystem Fund

Reserve & Treasury

Team & Founders

Seed Investors

Advisors

Network Validation Rewards

Total

TGE

Token Generation Event - initial token distribution

Cliff Period

Lock period before vesting begins

Vesting Period

Duration for gradual token release

Token Distribution & Vesting Analysis

Detailed breakdown of token allocation and release schedule designed for sustainable growth and community alignment.

Token Allocation

Distribution of 2.1Q Arciel Tokens across stakeholders

Token Vesting Schedule

Cumulative token unlock schedule over 4 years from TGE

Key Vesting Milestones

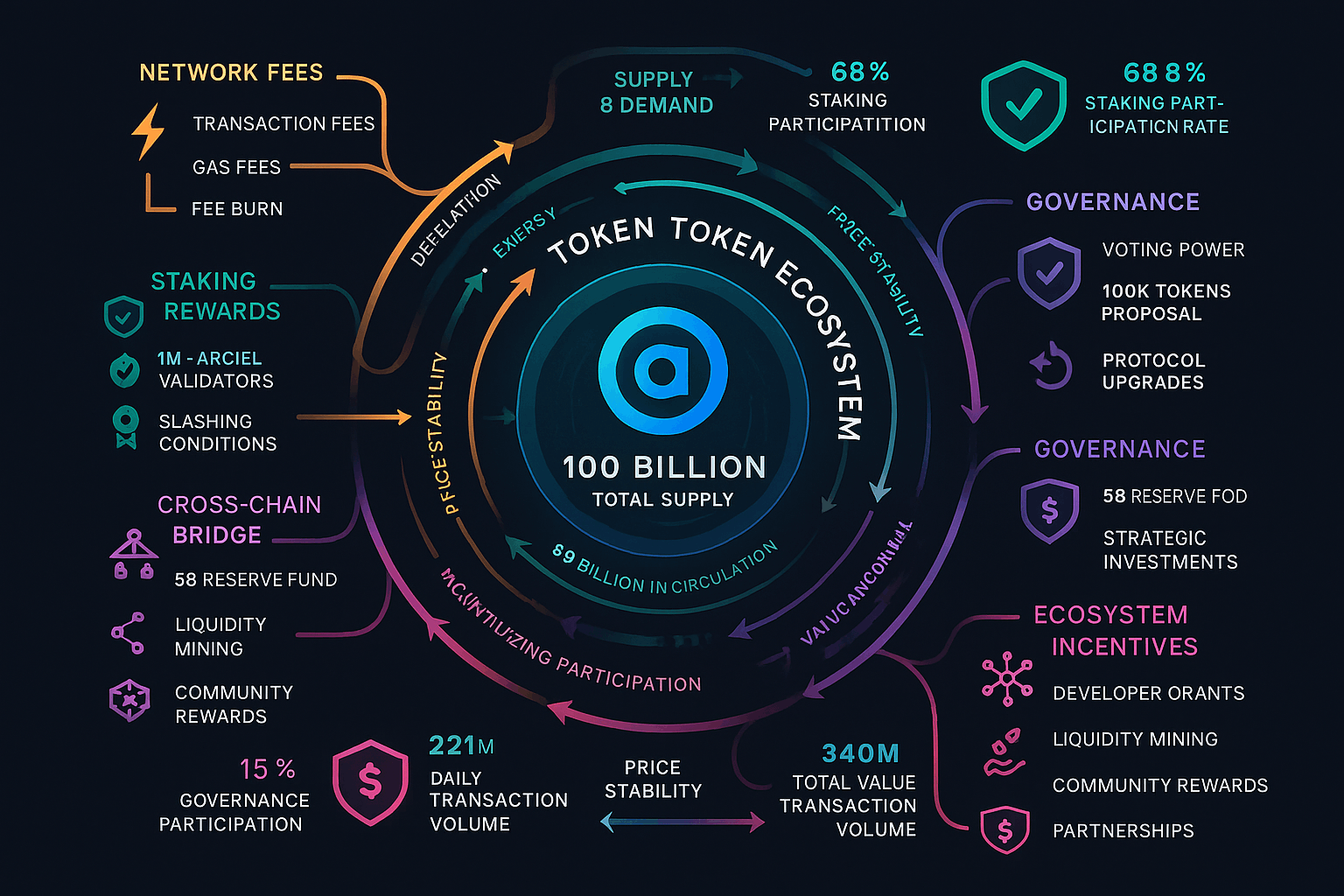

Token Ecosystem Flow

Visual representation of how Arciel tokens flow through the ecosystem, from staking rewards to governance participation